michigan sales tax exemption for farmers

The purpose of this form is to simplify the reporting of your sales and use tax. Its why farmers need House Bill 4561 and 4564 to bring the state department up to speed.

February 2022 Sales Tax Rate Changes

For more information visit Alger Countys MSU Extension website or call Alger 906-387-2530.

. Amendments to clarify the law. Sales Tax Return for Special Events. Claim for Farmland Qualified Agricultural Exemption for Some School Operating Taxes.

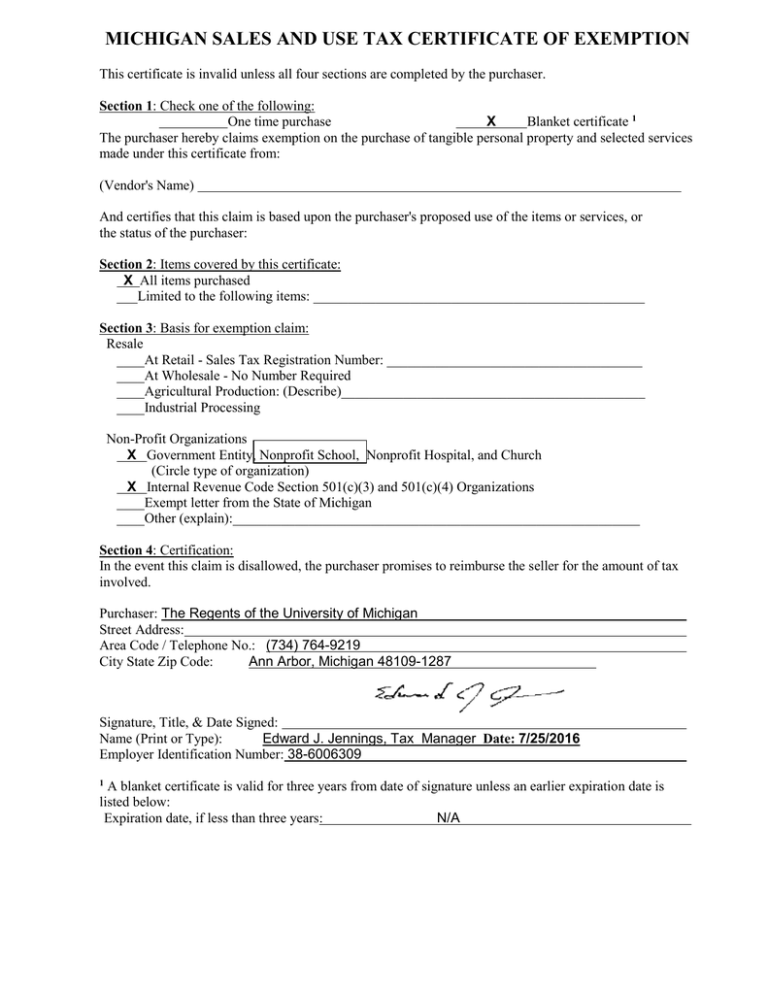

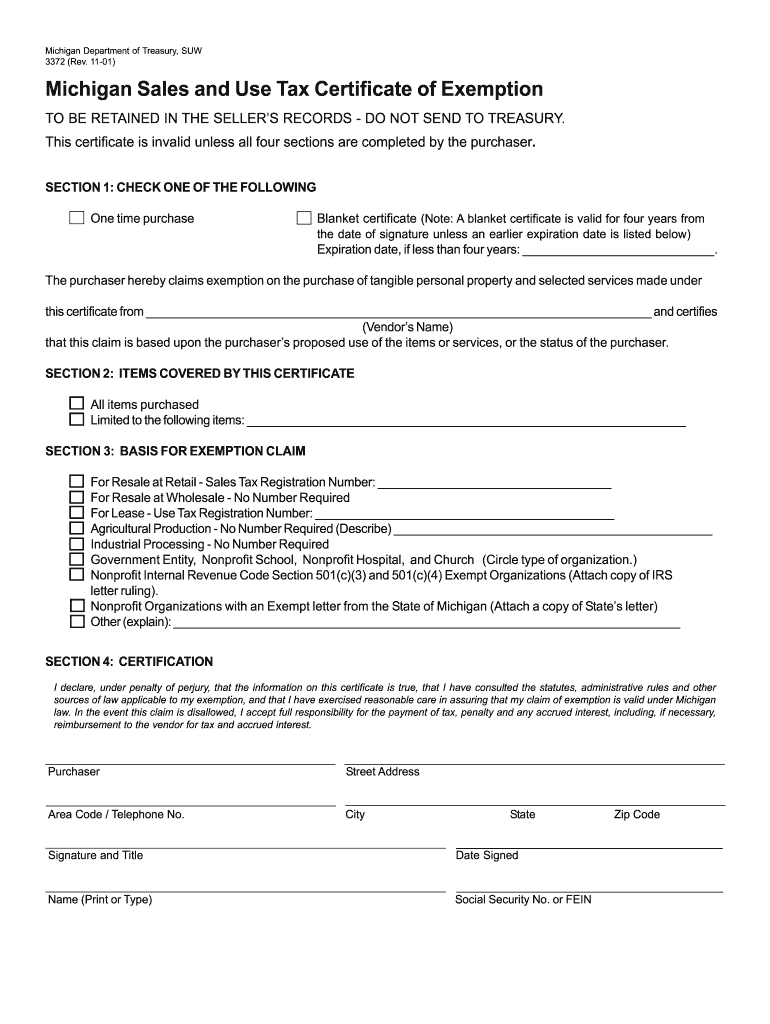

This exemption claim should be completed by the purchaser provided to the seller. Michigan Sales and Use Tax Certificate of Exemption. Several examples of exemptions to the states sales tax are vehicles.

How To Get A Farm Tax Exempt In Michigan. Sales and Use Tax We support. Use tax of 6 must be paid to the State of Michigan on the total price including shipping and handling charges of all taxable items brought into Michigan or purchases through the internet.

The buyer must present the seller with a completed form at. Without the bills officials who havent kept pace will continue enforcing nebulous. Michigan Sales and Use Tax Contractor Eligibility Statement.

You should never use your social security number for retail purchases. Michigan Department of Treasury 3372 Rev. Agricultural field burning reduction Expired January 1 2011.

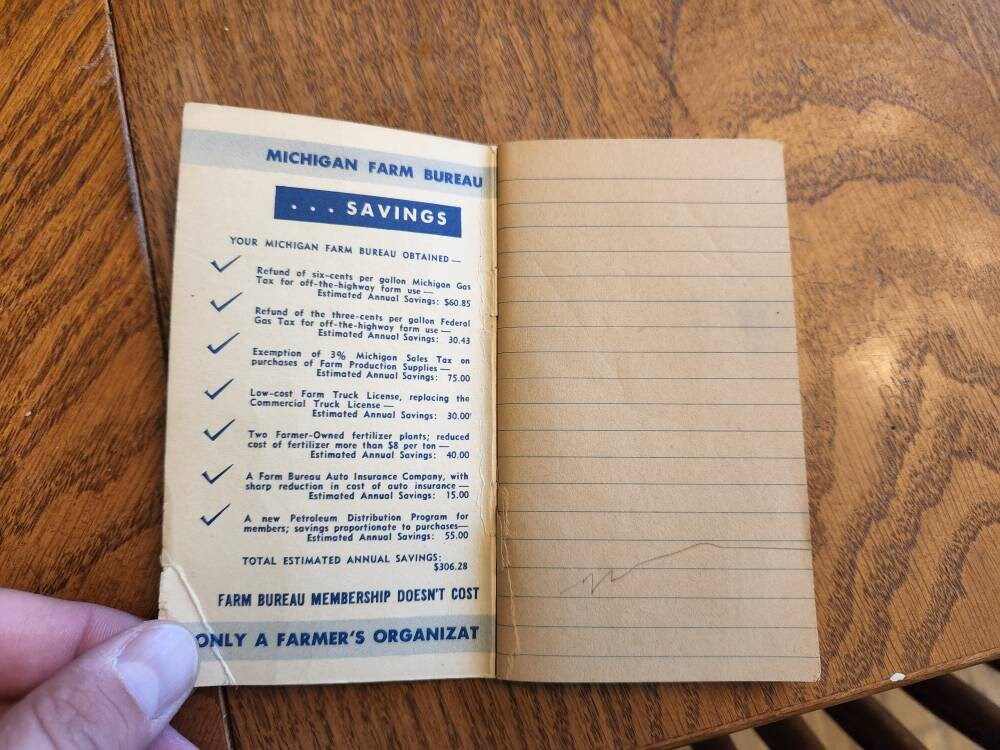

In Michigan certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. There are certain tax exemptions for people who own farms and work. Additionally specialty crops such as those developed by the Michigan Department of Agriculture and Rural Development MDARD are exempt from sales tax.

A continuation of the agriculture sales tax exemption for the. The agriculture exemption from state sales and use tax based upon the use of the product. Form 3372 Michigan Sales and Use Tax Certificate of Exemption is used to claim exemption from Michigan Sales and Use Tax.

The Michigan Senate today passed legislationunanimously and with bipartisan supportto preserve agricultures existing sales and use tax exemptions. There is no such thing as a Sales Tax Exemption Number for agriculture. Agricultural Land Value Grid.

Perfect answer In order to qualify for the exemption owners of parcels that are not classified agricultural must file an affidavit. The Farm Business Basics session will discuss. Retail sales tax and use tax exemptions are available to qualified farmers for the purchase or use of certain equipment.

For transactions occurring on and after October 1 2015 an out-of-state seller may be required to remit sales or use tax on sales into Michigan if the seller has nexus under amendments to the. In summary the law clarifies that direct and indirect farm-related equipment purchases are not subject to the sales and use tax. Sales tax is set at 6 percent in the state of Michigan for all taxable retail sales with some concessions however.

01-21 Michigan Sales and Use Tax Certificate of Exemption. It also allows tangible personal property. You must first be registered with Streamlined.

As a result farms. For other Michigan sales tax exemption certificates go here. Hobby farm rules farm business.

Farms are defined as any place from which.

Michigan Sales Tax Exemption Fill Online Printable Fillable Blank Pdffiller

How To Get A Certificate Of Exemption In Michigan Startingyourbusiness Com

Sales And Use Tax Regulations Article 3

Illinois Grain Farms Impacts Of Removal Of Sales Tax Exemptions Agfax

Michigan Sales And Use Tax Certificate Of Exemption

Michigan Residents Use Tax Exemption My Tractor Forum

Michigan Sales Tax Exemption For Manufacturing Agile Consulting

Missouri Sales Tax Exemption For Agriculture Agile Consulting

Amazon Certificates Required State For Exemption Tax Refund User Guide Manuals

How Mi Property Taxes Are Calculated And Why Your Bills Are Rising

Vintage Michigan Farm Bureau Advertisements Michigan Farm Etsy

Tax Exemption On Farm Buildings Extended Morning Ag Clips

Resale Certificate Michigan 2001 Form Fill Out Sign Online Dochub

Form E 595e Fillable Streamlined Sales And Use Tax Agreement Certificate Of Exemption

Michigan Real Estate Sales Tax Determination Of Property S Taxability

Small Business Property Tax Exemption Claim Under Mcl 211 Fill Out Sign Online Dochub